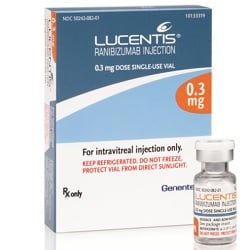

Roche ($RHHBY) now has another approval under its belt for eye drug Lucentis. And it's in a market it can call its own: Lucentis is the first U.S.-approved treatment for diabetic retinopathy (DR) in patients with diabetic macular edema (DME).

Roche ($RHHBY) now has another approval under its belt for eye drug Lucentis. And it's in a market it can call its own: Lucentis is the first U.S.-approved treatment for diabetic retinopathy (DR) in patients with diabetic macular edema (DME).

That's an edge Roche can now boast over Regeneron ($REGN) rival Eylea. While both meds have the regulatory green light to treat DME--which hits almost 750,000 U.S. patients, Roche notes--only the Swiss pharma can say its drug heals retinal damage in those patients. Together, DME and DR are a leading cause of blindness in U.S. adults under the age of 55.

"While there are various options for treating diabetic macular edema, before today none were approved showing improvement in retinopathy," Roche Chief Medical Officer Dr. Sandra Horning said in a statement. "With today's approval, people with diabetic macular edema now have a FDA-approved medicine that showed meaningful improvements in retinal damage from diabetes, in addition to the established improvement in vision."

But while Roche may be alone in the field now, Eylea is hot on its trail. The FDA is already reviewing the hard-charging med for the same indication, and the Regeneron drug grabbed the agency's priority review tag early last December.

It wouldn't be the first time Eylea has put the heat on Lucentis since it arrived on the scene in November 2011. Last July, it picked up its DME go-ahead from the FDA--an indication the Roche drug nabbed in 2012. Just a couple of months later, Eylea won FDA permission to market Eylea for macular edema following retinal vein occlusion, another nod Lucentis already had.

Roche will do what it can with its first-to-market advantage in diabetic retinopathy. A quick market-share grab would help pad the $1.7 billion in U.S. sales Lucentis churned out in 2014--which landed it in fourth place on the list of Roche's top sellers.

But as the company's top-performing noncancer drug, Lucentis will have a little more weight on its shoulders as the new year progresses, some analysts say. "They really need to strengthen the top line because we know the oncology market will become more and more competitive," Baader-Helvea's Odile Rundquist told Bloomberg last month.

- read Roche's release

Special Reports: Top 15 drug launch superstars - Eylea | The top 10 pharma companies by 2013 revenue - Roche