|

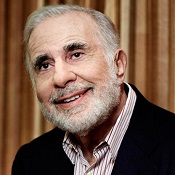

| Carl Icahn |

Activist investor Carl Icahn is jumping into the biopharma fray once again, this time getting involved with struggling obesity drugmaker Vivus.

On Wednesday, his Icahn Enterprises offered to buy up all of the company's convertible notes at a price of $680 per each $1,000 note. The offer will run through Oct. 7, the company said.

Investors were happy to hear the news, sending Vivus' stock up more than 26% at press time. The company has faced a host of setbacks as of late as weight-loss drug Qsymia has flagged; in July, the drugmaker halved its sales force, shrinking it by 50 reps for the second straight quarter.

Icahn is notorious for stirring things up in the biopharma space, and he hasn't been shy about touting the change he's created through activist investing. Last year, he chalked up a win for his strategy after a CEO switch he orchestrated at Forest Labs led to the sale of the company to Actavis.

"Our investment in Forest is a textbook example of the tremendous shareholder value creation that can be achieved when boards and managements work hand in hand with activist investors, as opposed to wasting corporate assets in unnecessary fights," he said at the time.

While the reason behind Icahn's interest in Vivus is still unclear, if he does have something up his sleeve, it won't be the company's first run-in with a rebel shareholder. In 2013, First Manhattan Co.--unhappy with the company's decision to market Qsymia alone--ignited a contest that ultimately sent then-CEO Leland Wilson and multiple board members packing. Among the replacement board members was Alex Denner, who had left Icahn's organization to start his own fund.

Vivus has also already had some buyout interest too, albeit mysterious. Last May, 9.65% shareholder Aspen Investments--a limited liability corporation registered in Delaware--announced its desire to pick up the rest of the company for $640 million. At that time, Aspen had been registered in Delaware for just a couple of weeks, and the majority of its stake in Vivus--which it had built up earlier that month--was in forward purchase contracts, rather than shares.

- read the release

Special Reports: Limited attention span? Focus on these market shake-ups in 2015 | 10 top drug launch disasters | Pharma's top 10 M&A deals of 2014 - Actavis/Forest Laboratories