|

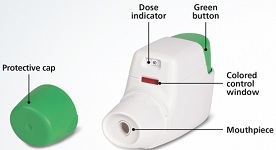

| Tudorza--courtesy of Forest Laboratories. |

Forest Laboratories is in dire need of a Bloody Mary for its still-severe Lexapro hangover. The U.S.-based drugmaker fell short of low expectations for the third quarter, thanks to a 41% drop in sales, largely because of generic competition for the blockbuster antidepressant. And the company ($FRX) ratcheted back predictions for its full-year results.

For the quarter ended Dec. 31, Forest scored a per-share loss of 58 cents, compared with analyst forecasts of 14 cents, Reuters reports. Sales dropped to $678 million from $1.2 billion year-over-year; analysts expected $761 million. Forest now expects adjusted EPS to fall into the low end of its earlier forecast of 45 cents to 60 cents.

Not surprisingly, Forest's stock was down on the news. But some analysts pointed out that Forest's management is mixing a hangover remedy now. Whether it will provide real relief is the question. "The bottom line is that we view these near-term numbers as not overly meaningful as the focus remains on management's ability to launch Tudorza and Linzess," Cowen & Co.'s Steve Scala said in an investor note (as quoted by Bloomberg).

Tudorza is Forest's new treatment for chronic obstructive pulmonary disease (COPD), and Linzess is a constipation remedy, launched just last month (the latter in concert with partner Ironwood Pharmaceuticals). The two drugs racked up $12.2 million and $19.2 million in stocking-up sales out of the gate.

Forest's record with other recent launches is mixed. Sales of drugs launched in 2011--Daliresp for COPD, the antibiotic Teflaro, and Viibryd, a Lexapro follow-up--are growing. In fact, they doubled year-over-year. But they're all still in the low-ish double digits, at $40.6 million, $11.5 million and $18.9 million, respectively. And Forest's Alzheimer's drug Namenda is on its way off patent as well.

CEO Howard Solomon, who weathered an acrimonious proxy fight with activist investor Carl Icahn last year, remains staunchly positive about his new products. "We believe sales ... will ultimately equal and exceed the sales lost following the expiration of Lexapro's exclusivity and the potential loss in subsequent years of Namenda's exclusivity," Solomon said in a statement.

- see the release from Forest

- read the Reuters story

- get more from Bloomberg